Overview

Retail group with almost 4,000 retail points in Europe

This retail group has nearly 4,000 retail points across Europe. It is based in France and operates globally, with a significant presence in Belgium, Portugal, and Poland. The group consists of 9 store brands in various retail segments, totaling approximately 4,000 retail points.

The retail group had been searching for a tool that could provide precise forecasts regarding its daily financial balance situation. Specifically, they needed visibility into their cash surplus or deficit. Prior to finding a solution, cash flow predictions were done manually on a daily basis and updated weekly. There was a pressing need to enhance forecast accuracy and automate the process.

Solution

Cash flow forecasting using Machine Learning techniques

DecisionBrain provided a solution by developing a prediction engine for all of the Group’s financial incoming and outgoing cash flows, forecasting the daily cash flows for the next 3 months. A “supervised learning” approach was used, consisting of creating a Machine Learning (ML)model based on historical data and applying it to predict future flows.

The solution consisted of:

- Identifying groups of flows with similar rules. The more granular a flow grouping is, the more precise the results. However, higher granularity implies more Machine Learning exercise and time to tune and maintain the models. The original grouping of flows into 56 groups was further aggregated to 10 groups.

- Identifying features and rules to predict the flows, like, for example, day of the week or day of the month

- Selecting the training period, that is the period of historical data used to create the model.

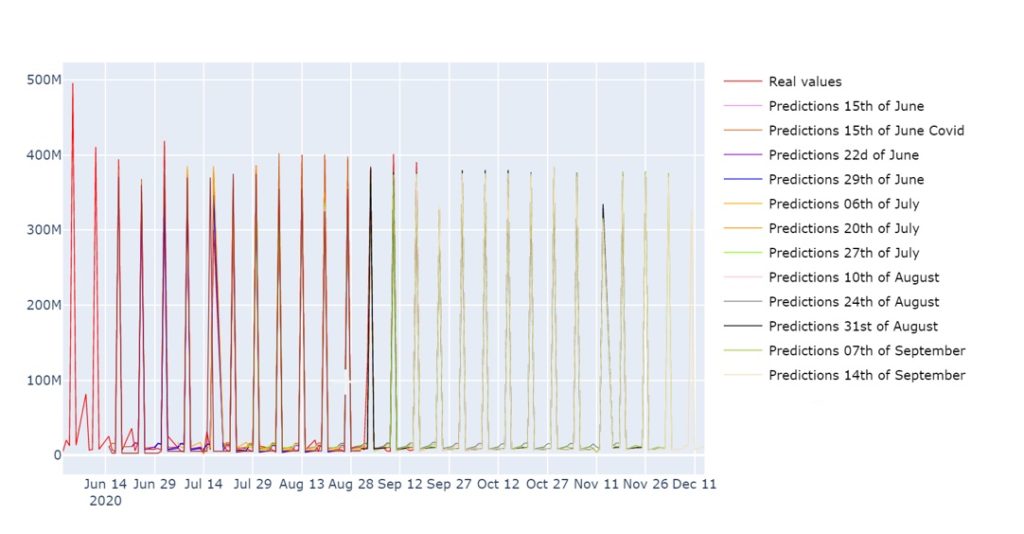

- Investigating data outliers. This consists of either assigning a new feature, excluding it from the model, or creating a separate machine learning model. For example, confronting the COVID-19 and post-COVID-19 period, which required additional reactive tuning.

- Finding an appropriate machine learning algorithm, which provides the lowest error.

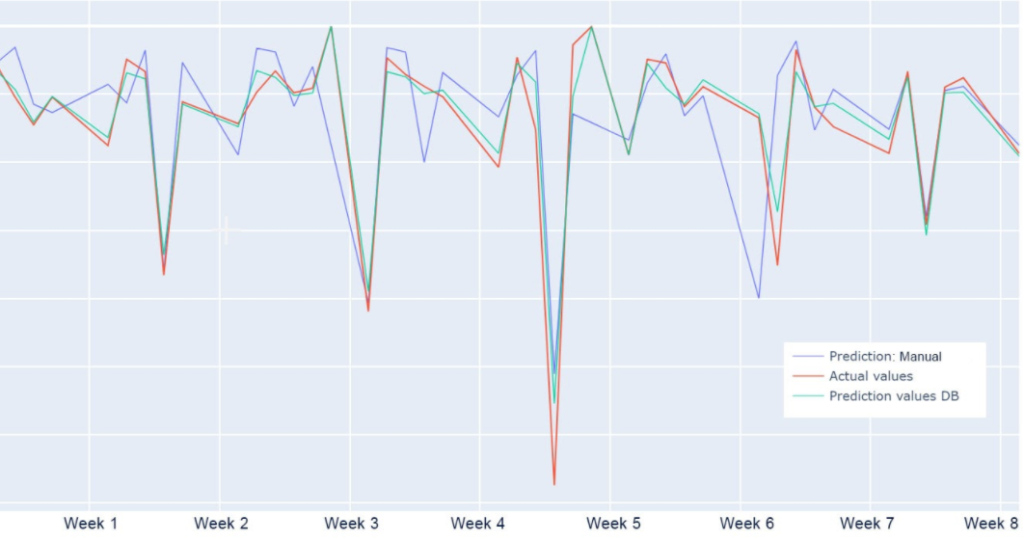

- Running the tests and comparing the model results to the manual results, in terms of mean absolute error divided by the mean value of real data where the mean absolute error is the average absolute difference between prediction and real values.

Results

Model predictions were consistently and sizeably better than manual prediction

The main objective of DecisionBrain’s solution was to improve manual predictions. After a live test that ran for 4 weeks, it was proven that model predictions were consistently and sizeably better than manual prediction both on aggregate and at flow group level.